tennessee inheritance tax laws

IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses. Until that time estate.

Estate Planning Tax Rule You Should Know Batsonnolan Com

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State.

. If a decedent had a spouse but no children or. There are 38 states in the. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time.

The inheritance tax is different from the estate tax. In January of 2016 Tennessee repealed its inheritance tax to encourage residents to continue to live and retire within the state. In 2016 the inheritance tax will be completely repealed.

The inheritance tax applies to money and assets after distribution to a persons heirs. Although Tennessee is phasing out its inheritance tax the federal government imposes an inheritance tax only for larger estates. Tennessee is an inheritance tax and estate tax-free state.

Also in this case you need to file Form 709. For example the state of Tennessee does not follow strict community property inheritance laws which means you must be careful when it comes to creating an estate plan. What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate.

If the total Estate asset property cash etc. The federal exemption amount in 2014 is. It allows every Tennessee resident to reduce the taxable part of their.

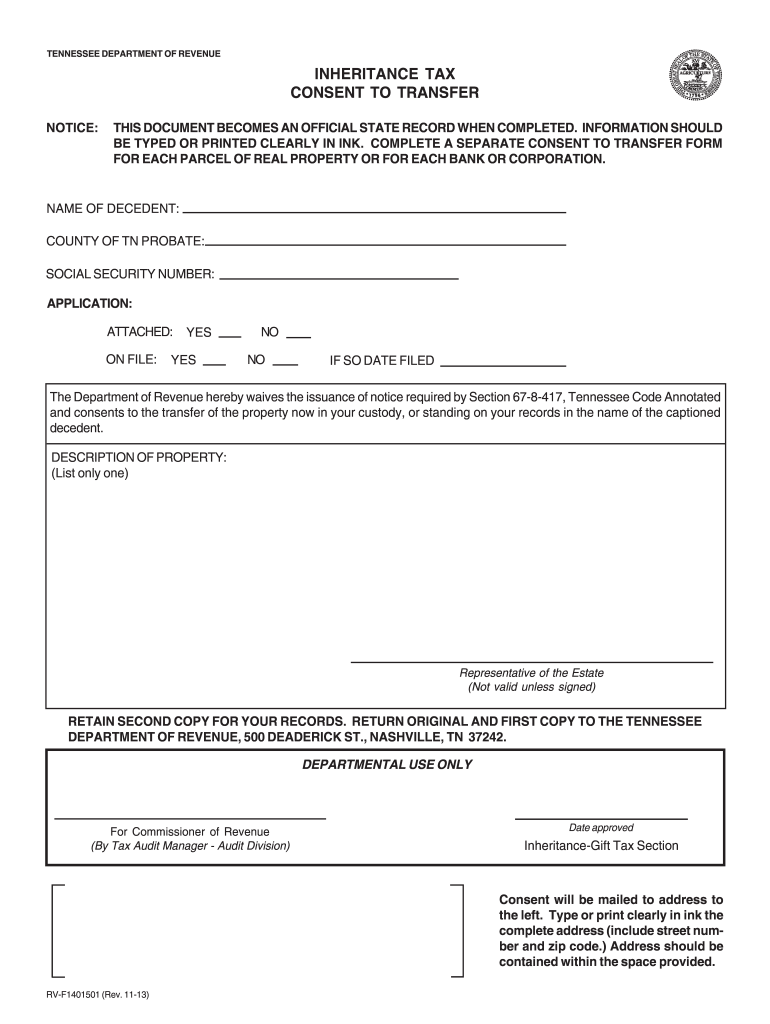

For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within. Since the Tennessee legislative code refers to both an inheritance tax and an estate tax this article refers to the death tax that is currently collected under Tennessee law as. Tennessee Inheritance and Gift Tax.

If a decedent had children but no spouse the children take everything. Tennessee Inheritance Tax Laws. Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax.

When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. There are NO Tennessee Inheritance Tax. Inheritance taxes in Tennessee.

IT-11 - Inheritance Tax Deductions. Posted on Sep 15 2013 957PM by Attorney Jason A. Gift and Generation-Skipping Transfer Tax Return.

Up to 25 cash back Tennessee Terminology. In Tennessee the intestate succession laws are. Those who handle your estate following your death though do have some other tax returns to take care of such.

All inheritance are exempt in the State of Tennessee. Tennessee Inheritance Tax When is the Tennessee inheritance tax due to the Tennessee Department of Revenue. We hope the following information provides some basic information about Tennessees.

The only situation where this tax might be owed is.

Is There A Tennessee State Estate Tax Mendelson Law Firm

New Tennessee Laws To Take Effect July 1 2022 Tennessee Senate Republican Caucus

What Is An Inheritance Tax And Do I Have To Pay It Ramsey

Complete Guide To Probate In Tennessee

How Probate Works In Tennessee Herndon Coleman Brading Mckee

Moved South But Still Taxed Up North

Tennessee Rv F1310501 Fill Out Sign Online Dochub

Gift And Estate Tax Exclusions 2022 Cool Springs Law Firm Brentwood Tn

Is There A Tennessee State Estate Tax Mendelson Law Firm

State By State Estate And Inheritance Tax Rates Everplans

An Overview Of Tennessee Trust Law

Probate Category Archives Tennessee Estate Law Blog Published By Nashville Tennessee Estate Attorneys The Higgins Firm

Calculating Inheritance Tax Laws Com

Tennssee Archives Tressler Associates Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

2013 2022 Form Tn Rv F1401501 Fill Online Printable Fillable Blank Pdffiller

Tenncare Tax Waiver Fill Out Sign Online Dochub

North Carolina S Estate Tax Dying Out Estate And Elder Law Blog Estate And Elder Law Lexisnexis Legal Newsroom